California’s Prevailing Wage Law explained

California’s Prevailing Wage Law as part of the California Labor Code requires contractors to pay specific minimum wage rates for work performed on public works projects. Public Works projects are defined in the Labor Code as any construction, alteration, demolition, installation, maintenance, or repair work done under contact and paid for in whole or in part out of public funds. These types of projects are many and can include the construction of schools, the construction of roads, the maintenance of public buildings and also includes pre-construction and post-construction activities related to the projects.

How to figure out your prevailing wage rate

The minimum wage rates that are required to be paid are published by the State’s Department of Industrial Relations (“DIR”). The published rates include many different prevailing wage rates, which are based on the geographic location and the type of work that is performed. The rates are organized and published by the DIR in General Prevailing Wage Determinations, which set forth the rates for worker classifications (e.g., Laborer, Carpenter, Plumber, Operating Engineer, Inside Wireman, Painter, Street Sweeper, Iron Worker, HVAC Repair, Cement Truck Operator, Dump Truck Operator and many others ). The specific rates that are applicable for each craft, classification, or type of work, and for each geographic locality throughout the state, can be located on the DIR website at www.dir.ca.gov. Understanding how to read a General Determination is important to understanding the required rate. This can be complicated, and often when employers are paying the incorrect rate the workers never know they are being paid less than the required minimum wages they are due. Contact a prevailing wage attorney to help determine the proper rate for the work you are performing on a public work project.

Prevailing wage determinations

California Labor Code Section 1774 states that workers must be paid not less than the “specified prevailing rates of wages” to all workmen employed in the execution of the contract. These specific rates are found in the General Determinations, which correspond to the type of work actually performed by individual workers. As explained in the State’s Public Works Manual,

“A worker’s title or status with the employer is not determinative of an individual’s coverage by the prevailing wage laws. What is determinative is whether the duties performed by the individual on a public works project constitute covered work. An individual who performs skilled or unskilled labor on a public works project is entitled to be paid the applicable prevailing wage rate for the time the work is performed, regardless of whether the individual holds a particular status such as partner, owner, owner-operator, independent contractor or sole proprietor, or holds a particular title with the employer such as president, vice-president, superintendent or foreman. For example, a “working” foreman or a “working” superintendent– one who performs labor on the project in connection with supervisorial responsibilities – is entitled to compensation at not less than the prevailing rate for the type of work performed.”

These are important delineations in determining the proper rate and if you are unsure if you are being paid the correct prevailing wage rate contact a Prevailing Wage Attorney to help in the proper determination. Remember it is related to what duties are being performed and sometimes multiple rates apply during the course of a single shift because a worker may perform duties from multiple classifications. It is not uncommon for a person to perform the work of a Laborer when using a shovel to dig a ditch but then jump on a back hoe to finish the work and perform the duties of an Operating Engineer. This worker would be required to be paid two different rates for the work performed that day.

Need help determining your prevailing wage rate?

If you think you have been underpaid for your work, we can help you determine the proper rate you’re entitled to.

Basic hourly rate vs total rate

General Determinations include both a Basic Hourly Rate and the Total Hourly Rate for each location and classification. Employers are required by California law to pay employees the Total Hourly Rate, however they can pay part of it in hourly pay and part of it in benefits if they want. The Basic Hourly Rate is the minimum hourly wage that a worker can be paid for the hours worked. The Total Hourly Rate includes the Basic Hourly Rate and additional compensation for “employer payments” which are typically fringe benefits such as health insurance, vacation, pension and other “fringe benefits.” Because the worker is getting some benefits the Employer gets to take a deduction from the Total Hourly Rate.

If Employers do not choose to offer fringe benefits to employees of if the employees decline to participate in the fringe benefit programs, the Employer must pay the worker the Total Hourly Rate as the hourly rate for the hours worked. There are other guidelines that apply to the deductions that are taken by the employer. For example, to obtain an offset for the employer’s “actual cost” of the benefit provided to the employee that was paid into a bona fide health, pension, vacation, or fringe benefit plan it has to be paid irrevocably, and paid within a certain time frame. Either way, the total compensation paid by the employer to the employee must match the Total Hourly Wage set by the Director in the General Determination either in cash or case and benefits.

Prevailing wage rate example

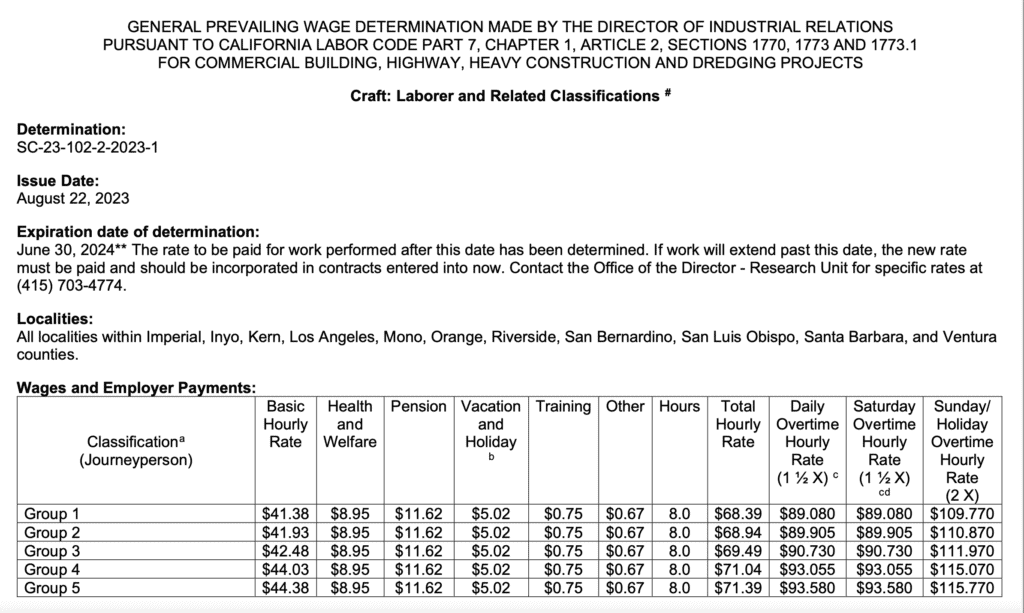

The Total Hourly Rate for a Laborer classification for Group 1 in Los Angeles County as determined by the Director in August 22, 2023 is $68.39 per hour straight time, $89.08 per hour overtime, and $109.77 per hour Sunday, Holidays and double time.

The actual Director’s determination for a Laborer Group 1 as of August 22, 2023 (Source: Determination SC-23-102-2-2023-1 issued August 22, 2023 for all localities within Imperial, Inyo, Kern, Los Angeles, Mono, Orange, Riverside, San Bernardino, San Luis Obispo, Santa Barbara, and Ventura counties.)

In this example, the Total Hourly Rate is composed of $41.38 in Basic Hourly Rate pay and $27.01 in fringe benefit allowances. Employers in this example must pay at least $41.38 per hour in wages for straight time. In addition, they must pay $27.01 into approved health, pension, vacation and training plans or pay it directly in wages. Either way, the total hourly wage paid by the employer must be $68.39 per hour for straight time.

If the employer is only paying the Basic Hourly Rate of $41.38 as the wages and no other benefits or compensation are being paid to the worker then the worker is being underpaid and is not receiving his required prevailing wages.

The General Prevailing Wage Determinations made by the Director of Industrial Relations are determined by certain geographic locations and specific work classifications.

Locations for the Director’s determinations can be Statewide classifications, a Northern or Southern California classification or by a specific County such as Los Angeles, San Diego, Riverside, San Bernardino, Orange County, Alameda, Sacramento, etc. You can review the different area location classifications and rates that are applicable for your public works project at https://www.dir.ca.gov/oprl/2017-1/PWD/index.htm.

Examples of worker classifications include boilermaker, blacksmith, iron worker, electrical utility lineman, telecommunications technician, telephone installation worker, tree trimmer, stator rewinder, electrical utility lineman, electrician or Inside Wireman, metal roofing, driver for on/off-hauling or to/from a construction site, asbestos workers, heat and frost insulators, inspector, carpenters, cement masons, operating engineers, drywall installer, laborer, landscape maintenance laborer, pile drivers, slurry seal workers, teamsters, tree trimmer, electrician, field surveyor, bricklayer, plasterer, plumber, roofer, sheet metal worker, water well driller and tile setter.

If by chance your type of work is not listed in any of the determinations by the Director of the DIR, the law establishes that the proper rate is the rate of the work that “most closely resembles” the type of work performed.

There is also the option for an awarding body (the entity that is contracting with the construction company) to ask the DIR for a Special Determination. A special determination is when the awarding body, prior to posting the project for bid, asks the DIR to provide a special determination just for the work of a specific project. If the DIR response prior to the contact being released for bid, that special determination will be the proper prevailing wage rate for that work performed on that project. But only that work for only that project.

Options for a Worker Who is Not Paid the Prevailing Wage

Workers who are being underpaid or not paid the proper prevailing wage rate have options. Of course, one option is to not do anything and just keep quiet and let the employer do whatever they want. Obviously, that is not always the best course of action to get an honest day’s pay for an honest day’s work. Other more effective options includes researching the proper rate online, or file a formal complaint with the DIR or they can contact a prevailing wage attorney at Donahoo & Associates, PC for a free, confidential consultation.

If you contact an attorney, be sure to inquire if the attorney has experience in California’s Prevailing Wage Law. The Prevailing Wage Law is a complicated part of the California Labor Code and much more detailed and complicated than traditional wage and hour litigation.

No attorney-client relationship is created by you looking at this blog, reading it, or posting on it. The information in this blog post (“post”) is provided for general informational purposes only and may not reflect the current law in your jurisdiction. No information contained in this post should be construed as legal advice from Donahoo & Associates, PC or the individual author, nor is it intended to be a substitute for legal counsel on any subject matter. No reader of this post should act or refrain from acting on the basis of any information included in, or accessible through, this Post without seeking the appropriate legal or other professional advice on the particular facts and circumstances at issue from a lawyer licensed in the recipient’s state, country or other appropriate licensing jurisdiction.